I always get very excited when a friend tells me they are thinking about buying a house. I start talking about suburbs and renovations, and signing up for real estate email alerts and making lists of must-have features. But often, my friend puts a halt to my obsessive babbling by telling me they haven’t yet gotten a loan. And sometimes - “I don’t have the first clue how to go about getting one,” they say ruefully.

And fair enough. I was in the exact same boat. And I’m not an expert now by any means either just because I went through the loan process. Getting a house can be very confusing and intimidating when you don't know the first step to take.

Nala and I at home. Photo by Heather Robbins of Red Images Fine Photography.

If you have a savings history to show, a good idea is to arrange a meeting with your bank but if the thought of walking into your bank gives you the chills, there are other options. I engaged the services of a mortgage broker, who negotiates with banks or credit providers to arrange loans and can help you cut out some legwork and get you a decent loan.

You can also get a home loan through a credit union such as People's Choice Credit Union where you can choose the kind of loan you'd like by meeting up with a home loan adviser or just completing the loan application process over the phone or online. A mortgage broking service or credit union can be a great way to get a low rate on your home loan, because they’ll show you a whole bunch of different loan types from a variety of lenders, whereas a bank will obviously just show you their home loans. When I got my loan, it was actually through a different bank than the one I had banked with (and had my bank accounts with) all my life, because they turned out to have the lowest interest rate and the best loan for my needs, and I have been very happy with it. Whatever way you apply for a loan, whether it’s through a bank, credit union or a mortgage broker ask about their fees so you can work this into your calculations.

My lounge room when I first moved in. Who needs a couch when you can sit on camping chairs and a pillow on the floor?

Some of my friends have asked me, “Should you apply for a loan first, or should you save up for a deposit beforehand?” Unless you have a fantastic income, I think for most people it’s always better to save for a deposit first, to show your credit provider you can sock away at something and be accountable. Most places recommend you save a deposit of at least 10% of what the house is worth. You can get loans with smaller deposits or no deposit loans, but this is a fairly good starting point. So if you want to buy a house worth $400,000, aim to save $40,000. Yeah I know, it is a lot. But it’s doable. You just have to break up your saving into smaller, less intimidating amounts.

Our lounge room when I first moved in... with hand-me-down furniture, dubious decorating tastes and a puppy.

Our lounge room today.

When I was 19 and in uni, I decided I wanted to buy a house by the time I was 24. (I also decided, at that same age, that I was going to be a magazine editor at 22, but that definitely didn't happen and thank God, I was an idiot at 22). I started saving my pennies for a deposit. While I was at uni I babysat, worked at a Baskin Robbins and later got a casual job at uni proofreading.

And oh, I was pretty stingy in some ways. I was never one of those teenagers who blew $100 on drinks every night I went out. (Besides which, anyone who knows me well knows if I ever tried I would be passed out on the floor after three mojitos). I still had characteristic teenage and early 20s splurges but much of the time, I would be the one looking at the menu of the local cheap-ass Italian place La Porchetta, choosing the entree-size pasta because it was $5 less than the main. I saved my babysitting money and my money from working at the local Baskin Robbins icecream store.

I didn't have the easiest run into getting a first house - but it was worth it the day I signed on the dotted line to make the Crap Shack mine. Which looks really crap in this photo. Thought not as crap as my weird stance.

It was addictive. I still worked at the icecream shop. I scooped so many damn icecreams one arm got musclier than the other, like some wonky female Popeye. Lots of my icecream scooping money got put into shares. I remember a succession of days where I would buy and sell quite rapidly, and on great days when I was VERY lucky I would sometimes make $800 to $900 in a day. With the shares, I am NOT recommending anyone to necessarily do this themselves to help save for a deposit, I am just telling you what I did. The share market is gambling, whatever way you look at it, and I always felt - even while I was buying and selling - that it was nothing but good luck and that eventually my luck would run out. And I haven’t had the confidence to do that in ages. Moving out has made me much more wary with my money; back then I had the security of living under my parents' roof.

My first real job! Meeting Ronnie Coleman while with MuscleMag. I am the one on the left.

I also started picking up more freelance writing. I was studying and working three jobs - my magazine job, my Baskin Robbins job and freelancing. On the worst days I was working 9-5 at the magazine, going to the work gym after work then straight to Baskin Robbins, then hitting my desk at 11 to work on a freelance story. Terrible crazy time and I would NEVER be able to live like that now! I socked away my money before I finally cracked from the pressure and made some lifestyle changes. After a while, I quit my job and it took me three months to get enough work to consider myself a full-time freelance.

Before I started house-hunting, I went on a big seven week backpacking trip around England and Europe with one of my best friends, which was something I wanted to do before I got a mortgage.

We did dumb stuff.

My friend was a freelance journo too, and we still wrote stories while we were away, working on them on ferry rides and sending interviews in internet cafes in the Greek Islands. When I got home from Europe, I was 24. I sold all my shares and felt like I had saved enough for a little deposit. It was time to start getting a loan.

I went to one home loans place and basically got laughed out of the branch. The freelance thing didn’t seem to put me in good stead. I did qualify for a loan - but it was such a paltry one it wouldn’t have bought me anything in Perth where I wouldn’t get raped or murdered taking the rubbish out. You guys know what the property market is like here! Homes are not easily affordable.

Then I saw a mortgage broker and it all started to fall into place. I got approved for a higher loan. Upon my dad’s advice, I didn’t borrow the full amount I was approved for, and was glad I didn’t – meeting mortgage repayments turned out to be hard enough when things in the Crap Shack started needing repairs!

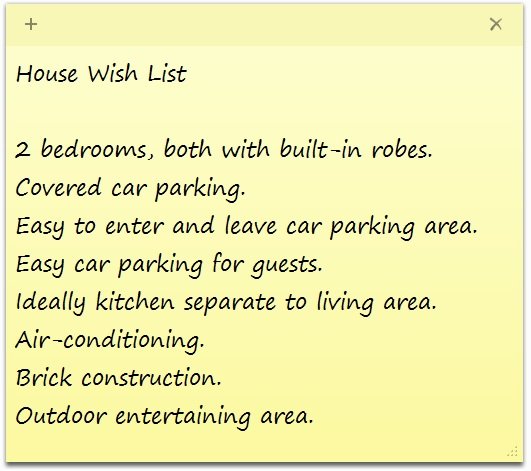

When it came time to house-hunting, I made a list of the lovely suburbs I wanted to buy in. I had signed myself up for real estate email alerts a year ago which helped me feel more confident that I had a good gauge on whether places were overpriced or reasonably priced. Then I made a list of all the must-have things I wanted.

Well. All the places in my budget in the suburbs I liked turned out to be either super-tiny, depressing, or both. A particularly memorable flat had a dead magpie right by the doorstep, a balustrade-less veranda that dropped into a communal, plant-less sandpit ‘garden’ four metres below, and rat poison in the tiny yellow kitchen. We looked at overpriced units where the previous elderly tenant had died, that had decrepit carpets that smelled like old lady's breath. I looked for what felt like ages – I think about five months.

Us at home in the Crap Shack. Photo by Heather Robbins of Red Images Fine Photography.

Very first world problem, I know, but I was getting quite dejected towards the end of my house-hunting. Nothing felt like 'yes' to me until I saw the Crap Shack. Mr Nerd, who was my boyfriend at the time, found it online. I hadn't even thought about the suburb, as it was a bit further out than the areas I had put on my list, but once he suggested it, it made perfect sense. It was much bigger – well a proper house - and had more land – than any of the apartments and units I had been looking at in my original list of glossier suburbs.

And within minutes of walking through the front door, I just had this very firm feeling that this was THE house, despite its flaws and dated bits - the yellow glass windows, stinky shagpile carpet, depressing sunroom and ugly dark brown face brick. Swoon. I had always daydreamed about a fixer-upper. So romantic!

Or not.

"We can do it!" I said happily as Mr Nerd sighed, guessing (correctly) that the bulk of this hard renovating work would fall on his shoulders.

Doing the yard.

I called the real estate agent that same evening and put in an offer the very next morning. Then it was moving house time. Five years later and here we are, STILL renovating. Oh, it is definitely taking a whole lot longer than I had originally naively envisaged!

Our ensuite renovation - one of the biggest reno tasks we've taken on so far.

I can vividly recall a particularly unpleasant time not long after I’d moved in. Mr Nerd had had to go away on a work trip, and it was a freezing cold autumn night. That crazy massive storm of 2010 had hit (remember the one that ruined all those cars with hailstones, flooded the city and caused a mini landslide in Kings Park?) and like much of Perth my power was out, not to be fixed for three days… there went my ability to work with it. The hot water system completely died and needed to be (expensively) replaced, so all I could take was freezing cold showers. And then, the drains blocked, because tree roots had gotten into them and blocked them up – something Mr Nerd later told me often happened when a house, like mine, had been shut up for a while and the gardens hadn’t been watered much. I was standing one night in a dark bathroom lit by candles, shivering after a freezing cold shower and mopping up ankle-deep water and sobbing because now I was broke, I was cold and I’d have to fork out for a new hot water system, a plumber and an electrician. Oh that was not a fun time, but we all need experiences like that don’t we?

Even though there have been times when going into a mortgage at a relatively young age has felt like a chore, like when it seems all your friends are still enjoying the freedom of spending their income on endless holidays and nights out, I don’t regret it at all. Having your own house is still awesome.

House parties - one of my favourite things to do in The Crap Shack - and I think having parties has been one of the best bits of having our own place. This is from our Survivor themed New Year's party a couple years ago.

Have you gotten a home loan? How did you get it? How did you save for a deposit? Did you learn from any mistakes, or was it a smooth process? Were you like me – did you miss out on any houses to be disappointed, only to realise later you love the place you wound up with even more? Maya x